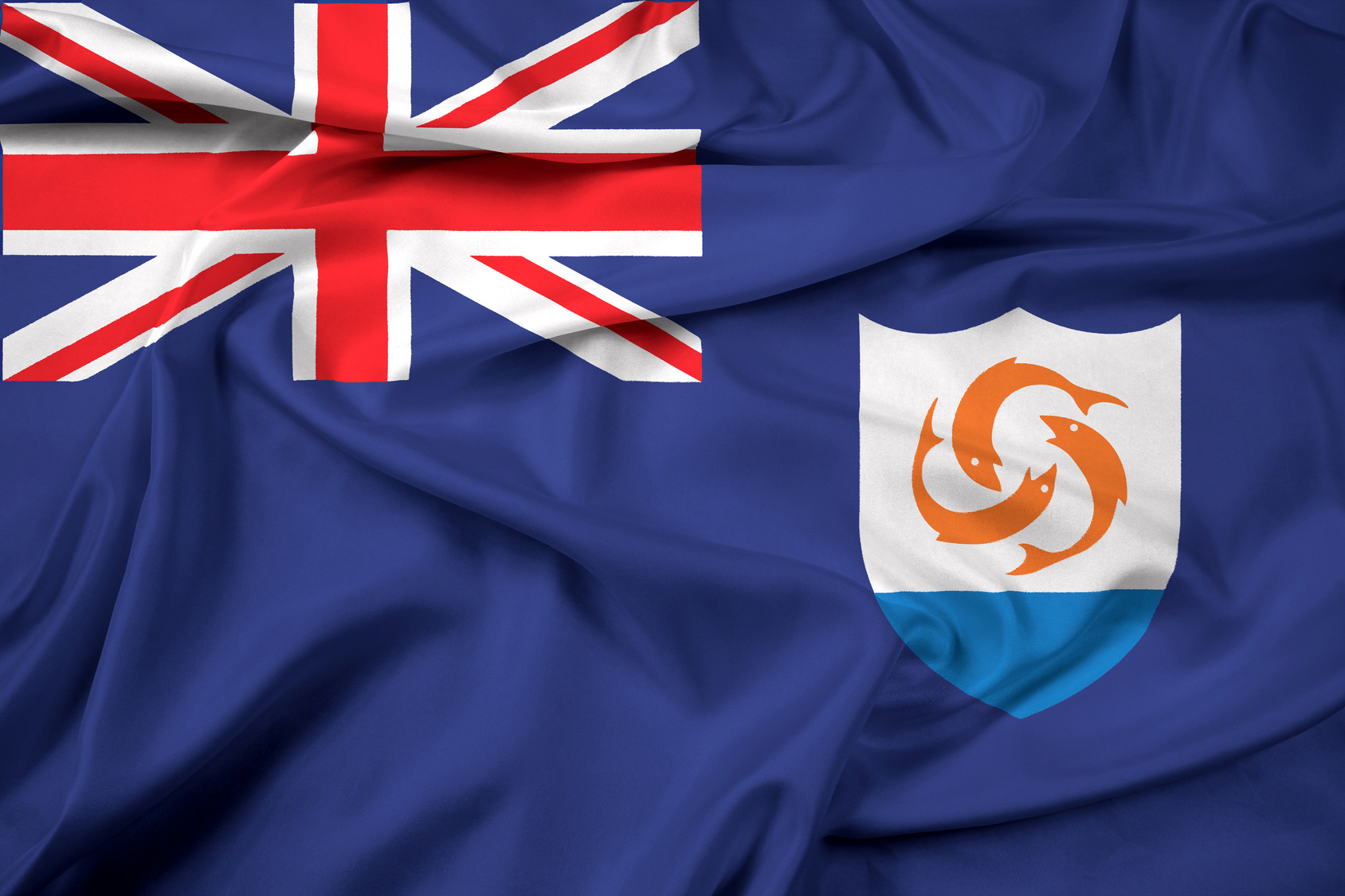

If you are considering incorporating offshore in order to save money on taxes and protect your assets from liability, there are several reasons why an Anguilla company formation may be the most appealing option for you.

Whether you are thinking about a trust, a real estate holding company or an international business corporation, Anguilla offers many incentives for setting up your structure in this jurisdiction.

Here are four benefits to an Anguilla company formation.

1. Reduced Taxes

Anguilla is an appealing offshore location for foreign investors because of its lower scale tax brackets on certain sectors and services. For residents of countries with extremely high taxes, setting up an offshore company is an attractive way to legally avoid the massive tax bill their income might incur in their home country.

Anguilla does not impose income taxes, estate taxes or capital gains taxes on individuals or corporations.

2. Ease of Probate

Anguilla company formation is also a viable option for people concerned about passing property onto their heirs without undue tax burdens and complicated probate procedures.

Passing property through an offshore company simplifies the process, making sure that children inherit the assets more rapidly and with less bureaucratic red tape.

Anguilla’s lack of estate taxes also ensures that your children will enjoy more of your legacy than if it were passed to the next generation through the legal system of another country.

3. Simplified Real Estate Ownership and Transactions

Offshore companies in countries like Anguilla are especially suitable for real estate holding and transfers.

The structure of an offshore company provides the added advantage of personal liability protection for the owner, in the case that an occupant or visitor is injured on the premises. For residents of the United States, where personal liability lawsuits are rampant, this kind of protection provides immeasurable peace of mind and financial insulation.

In the case of a real estate sale, fees are reduced and transactions are simplified when the offshore company is the entity which is making the transfer of shares.

4. Diversification of Assets

Some offshore mutual funds refuse to accept residents of the United States as investors because of the long arm of the country’s Securities and Exchange Commission (SEC).

Forming an offshore company in Anguilla, expands your investment opportunities to vehicles which may not be otherwise open to you due to your personal residency status.

A wider variety of investment opportunities is another advantage of forming an offshore company in Anguilla. With wider investment options, you have the ability to generate more income.

And there’s more good news: Anguilla has no capital gains tax, so you have the ability to reap more benefits from this bigger pool of investment opportunities.

Benefits of Anguilla Company Formation

Besides its beautiful climate and attractive landscape, Anguilla is an ideal location from a financial planning perspective as well. Whether you seek to preserve your assets and income from excessive taxation, burdensome probate or frivolous lawsuits, you may find the solutions you need in an offshore based in this Caribbean paradise.

Speak to a financial planner and offshore expert about the advantages to forming an offshore holding company or similar corporate structure in Anguilla.